Value-Added Tax (VAT) has become an essential component of the global tax system, helping governments generate revenue from goods and services. Among the various forms of VAT documentation, VAT1 stands out as a crucial element for businesses looking to comply with tax regulations. In this comprehensive guide, we will delve into the intricacies of VAT1, explaining its significance, application process, and the role it plays in the larger VAT framework. Additionally, we will touch upon the concept of ds01 online, offering insights into its relevance in the modern digital tax environment.

What is VAT1?

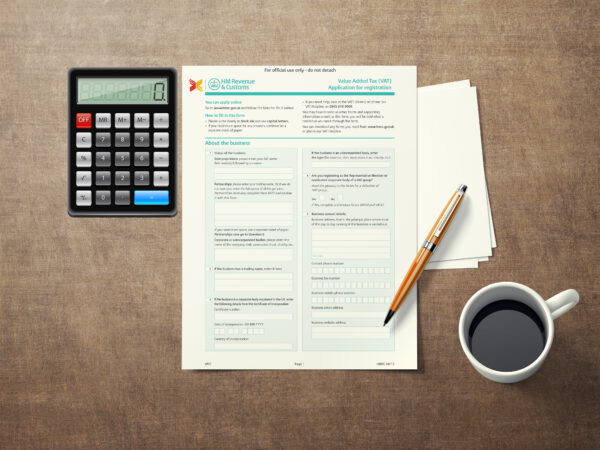

VAT1 is the form used by businesses to register for VAT with their respective tax authorities. It is a critical document for any business that meets the turnover threshold for VAT registration or chooses to register voluntarily. The VAT1 form ensures that businesses comply with their legal obligations and can claim VAT refunds on their purchases. Understanding the process and requirements for completing VAT1 is essential for businesses to avoid penalties and maintain smooth operations.

VAT1 registration involves providing detailed information about the business, including its nature, turnover, and the types of goods or services it provides. The form also requires businesses to declare their intention to start charging VAT on their sales. Completing the VAT1 form accurately and submitting it on time is vital for businesses to ensure they are VAT-compliant from the outset.

The Importance of VAT1 in Business Operations

For any business, being VAT-registered brings several benefits, and the VAT1 form is the gateway to these advantages. By registering for VAT, businesses can reclaim the VAT they pay on their purchases, which can significantly reduce their costs. This is particularly beneficial for businesses that deal with large volumes of transactions or high-value goods and services.

Moreover, VAT registration through the VAT1 form enhances the credibility and professionalism of a business. Customers and suppliers often prefer to deal with VAT-registered entities as it provides a level of assurance about the legitimacy and financial health of the business. Additionally, VAT registration allows businesses to issue VAT invoices, which are crucial for claiming input tax credits.

The VAT1 form also plays a vital role in ensuring businesses comply with the legal framework governing VAT. Failure to register for VAT when required can lead to substantial fines and penalties. Therefore, understanding and correctly filling out the VAT1 form is not just a bureaucratic necessity but a strategic move for any business looking to thrive in a VAT-regulated environment.

Navigating the DS01 Online Process

In the digital age, many tax authorities have streamlined the VAT registration process, allowing businesses to complete and submit their VAT1 forms online. This digital shift not only makes the process more convenient but also ensures faster processing and reduced errors. The ds01 online system is an example of such an innovation, providing businesses with an efficient way to manage their VAT registration.

The ds01 online system simplifies the VAT1 registration process by guiding businesses through each step, from providing business details to declaring their VAT intentions. This online platform ensures that businesses can complete their registration from the comfort of their offices, without the need to visit tax offices or deal with cumbersome paperwork. Furthermore, the ds01 online system offers real-time updates and notifications, keeping businesses informed about the status of their registration.

By utilizing the ds01 online system, businesses can also benefit from various support features, such as online help centers, FAQs, and customer support services. These resources ensure that businesses can resolve any issues or queries they might have during the VAT1 registration process. The convenience and efficiency of the ds01 online system make it an invaluable tool for modern businesses navigating the complexities of VAT registration.

The VAT1 Application Process: Step-by-Step Guide

To successfully register for VAT using the VAT1 form, businesses need to follow a systematic process. Here is a step-by-step guide to help businesses navigate the VAT1 application process:

-

Determine Eligibility: Before starting the VAT1 registration, businesses need to determine if they are required to register for VAT. This involves checking if their turnover meets the VAT threshold set by the tax authority or if they choose to register voluntarily.

-

Gather Required Information: Businesses need to collect all the necessary information required for the VAT1 form. This includes business details, such as name, address, and contact information, as well as financial information, such as turnover and types of goods or services provided.

-

Complete the VAT1 Form: The VAT1 form can be completed online or on paper, depending on the tax authority’s requirements. Businesses need to accurately fill out all sections of the form, providing the required information and declarations.

-

Submit the VAT1 Form: Once the form is completed, it needs to be submitted to the tax authority. Online submissions through systems like ds01 online are often faster and more convenient, ensuring quicker processing.

-

Receive VAT Registration Number: After the form is processed, the tax authority will issue a VAT registration number to the business. This number is essential for all VAT-related transactions and should be included on all VAT invoices.

-

Comply with VAT Obligations: Once registered, businesses need to comply with their VAT obligations, including charging VAT on sales, issuing VAT invoices, and submitting regular VAT returns.

Common Challenges and Solutions in VAT1 Registration

While the VAT1 registration process is straightforward, businesses may encounter some challenges. Here are common issues and solutions to ensure a smooth VAT1 registration:

-

Incomplete Information: Ensure all required information is collected and accurately provided on the VAT1 form. Missing or incorrect information can delay the registration process.

-

Technical Issues: When using online systems like ds01 online, technical glitches can occur. Utilize the support features available, such as help centers and customer support, to resolve any technical issues promptly.

-

Understanding Requirements: Some businesses may find the VAT1 form requirements complex. It is beneficial to seek professional advice or consult the tax authority’s guidance to ensure all requirements are met.

-

Timely Submission: Delays in submitting the VAT1 form can lead to penalties. Businesses should aim to complete and submit their VAT1 form well before the deadline to avoid any issues.

Conclusion

VAT1 registration is a critical step for businesses looking to comply with VAT regulations and reap the benefits of being VAT-registered. By understanding the VAT1 form, its importance, and the registration process, businesses can ensure they meet their legal obligations and operate efficiently. The advent of online systems like ds01 online has further simplified the process, making VAT registration more accessible and convenient.